Tools that support your goals.

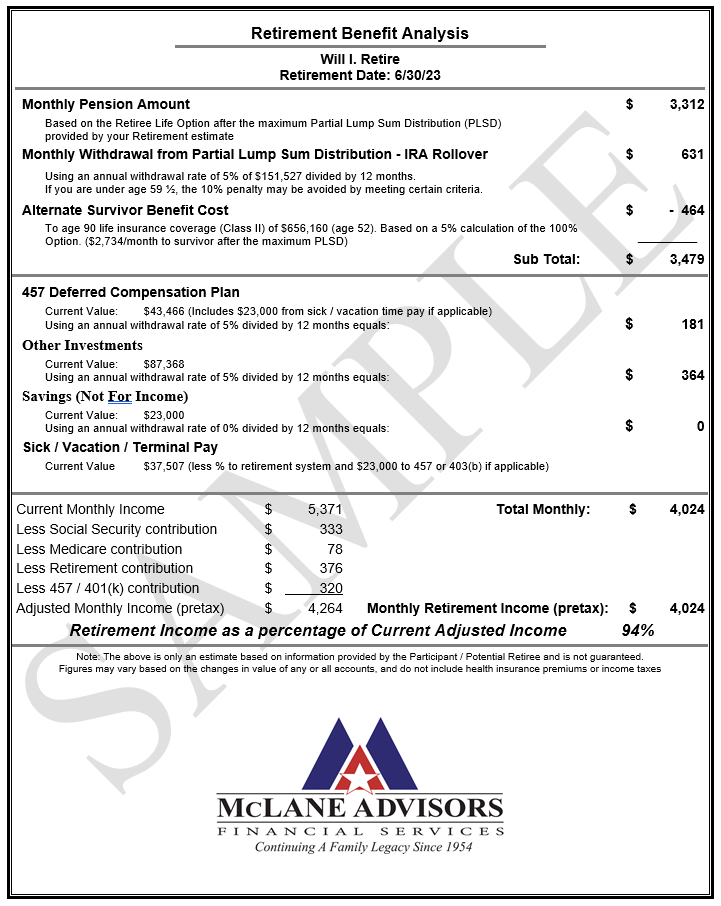

Retirement Benefit Analysis: (See below for Sample) This simple tool is very helpful for you and us when determining the strength of your retirement and the overall health of your assets.

Online access: Having constant access to your accounts is a high priority. We utilize multiple sources and tools that provide daily market values, returns, and historical performance. These tools help you stay informed and provide clarity about the status of your investments.

Illustrations: Through an investment illustration you can see how historical performance of the market would have affected an account in our various strategies.

What to expect as a client?

McLane Advisors is committed to helping you build a bright retirement future. We work diligently to keep you on the path of financial freedom.

How we do this?

- Communication is key. When you call McLane Advisors, we strive to have someone answer the phone at all times during regular business hours.

- Whether by phone, text or email, McLane Advisors is available to answer your questions and fully present for all your financial needs.

- Personal reviews are key to keeping on track with goals. McLane Advisors strives to keep you up to date by having face to face appointments either in person or through social media. These reviews allow us to make adjustments based on your goals as they might change throughout your life.

- Consistency. As a family owned and operated business, we provide stability and familiarity to you. We are very selective with who we hire and we strive to know each of our clients on a personal basis so you feel a connection every time you call.

Long-term focus

McLane Advisors will help you achieve financial freedom now, and throughout your lifetime for both you and your loved ones.

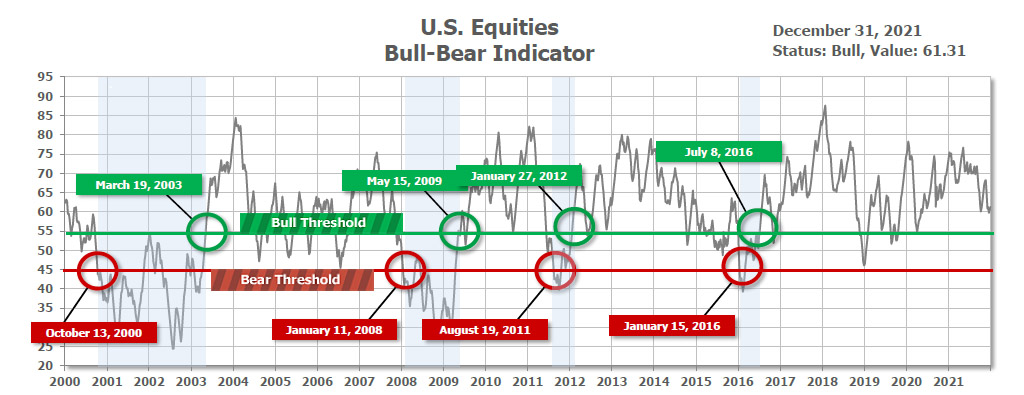

This is accomplished by having a disciplined and long-term approach to your finances and by removing emotional decisions by using many sources of fundamental data as well as trends to make educated decisions in your behalf.

“Here are a couple of the many tools we use to forecast market trends and make allocation decisions”

Retirement Analysis

Our Retirement Analysis is one of the more powerful tools we offer our clients. Over the last few decades, we have done thousands of these for people of all walks of life. The sample below is especially catered toward government employees.

Download a Sample of Retirement Benefit Analysis